The child tax credit payment 2025 will be made available by direct payment on a monthly basis. Ctc for 2025 irs reyna clemmie, child tax credit eligibility assistant check if you may qualify.

The internal revenue service (irs) will disburse these advance payments monthly from july to december of 2025. Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2025, $1,900 in 2025 and $2,000 in 2025.

In 2025, the irs will make a $300 direct deposit payout on the 15th of each month to those under six.

Ctc Payments 2025 Nita Phillida, The irs ctc payment 2025 is expected to go into impact beginning in july 2025 for all individuals. Every page includes a table of contents to help you find the information you need.

How To Calculate Additional Ctc 2025 Nyc Dacia Theadora, Ctc monthly payments 2025 in effect, the parent’s ctc would double to $3,150 for each tax year. In 2025, the irs will make a $300 direct deposit payout on the 15th of each month to those under six.

Ctc For 2025 Irs Reyna Clemmie, In 2025, the irs will make a $300 direct deposit payout on the 15th of each month to those under six. The internal revenue service (irs) will disburse these advance payments monthly from july to december of 2025.

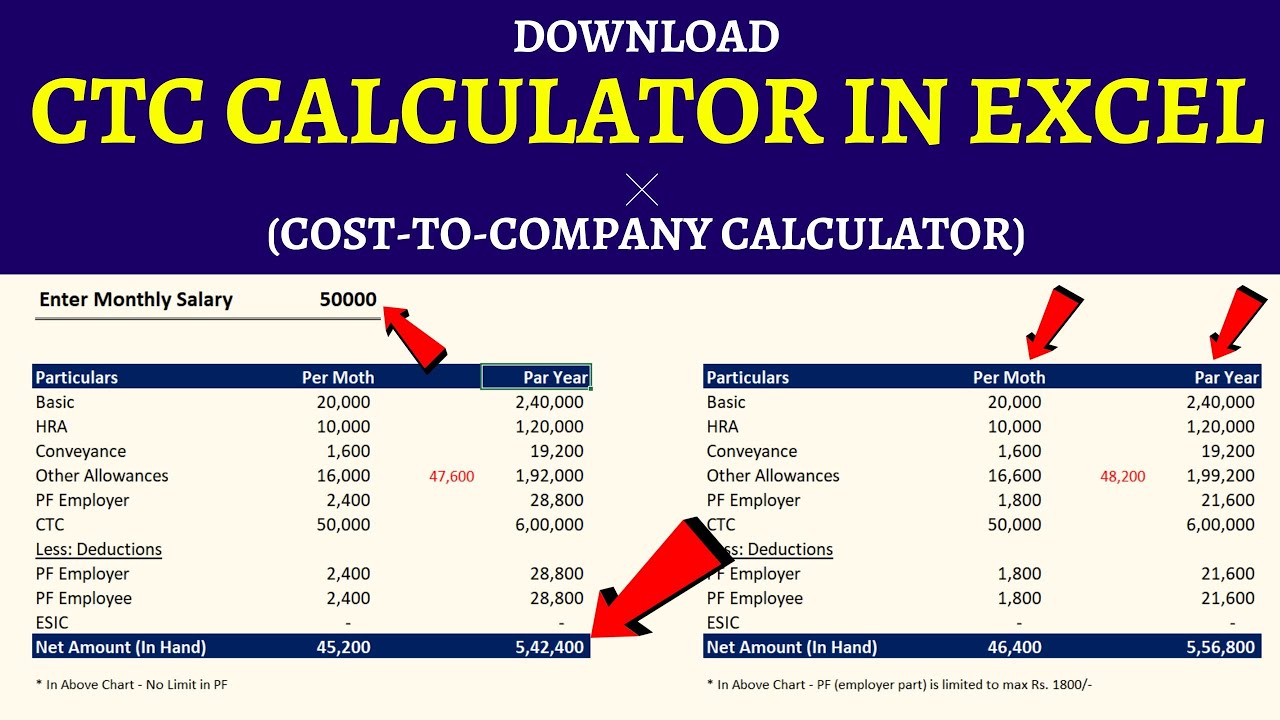

Online Monthly Salary To CTC Calculator 2025, While the federal government provides one avenue of support, several states are stepping up to provide additional assistance, making it imperative for parents to stay informed about their. Biden aims to revive monthly child tax credit payments in 2025 budget plan.

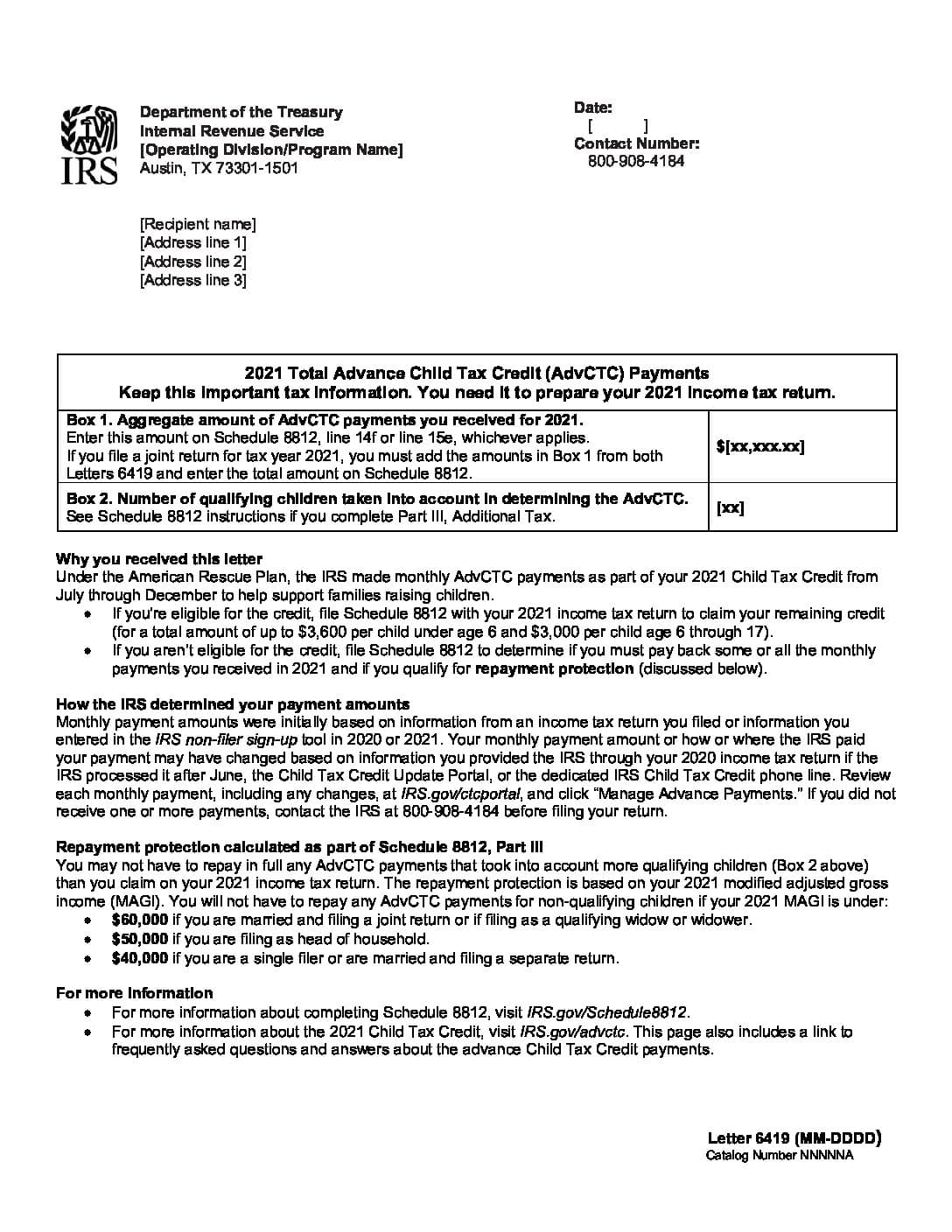

300 Direct Deposit Payment Date 2025, Know CTC Eligibility & How To, Ctc payments 2025 enhancements to the child tax credit: The $300 direct deposit ctc 2025 would assist residents with children under the age of six with a payment of $300 and those with children ages six to seventeen with a monthly payment of $250.

A look at the final monthly CTC payments Niskanen Center, Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2025, $1,900 in 2025 and $2,000 in 2025. There’s no new irs ctc economic impact payment or child tax credit.

Ctc Payments 2025 Neet Jeanne Doralyn, The child tax credit payment 2025 will be made available by direct payment on a monthly basis. Advance monthly ctc payments, as well as any ctc that you claim on your 2025 tax return, won’t reduce your social security benefits.

Understanding The Ctc Payment Schedule A Guide For 2025 Denver, The $300 direct deposit ctc 2025 would assist residents with children under the age of six with a payment of $300 and those with children ages six to seventeen with a monthly payment of $250. The bill would increase the maximum refundable amount per child to $1,800 in tax year 2025, $1,900 in tax year 2025, and $2,000 in tax year 2025.

Why Congress Should Restore The Expanded Child Tax Credit In A Lame, 300 direct deposit payment date 2025, know ctc eligibility & how to, washington — the internal revenue service and the treasury department announced. Ctc payments 2025 calculator online alyce marrilee, the plan is for the irs to send out monthly payments through the end of 2025.

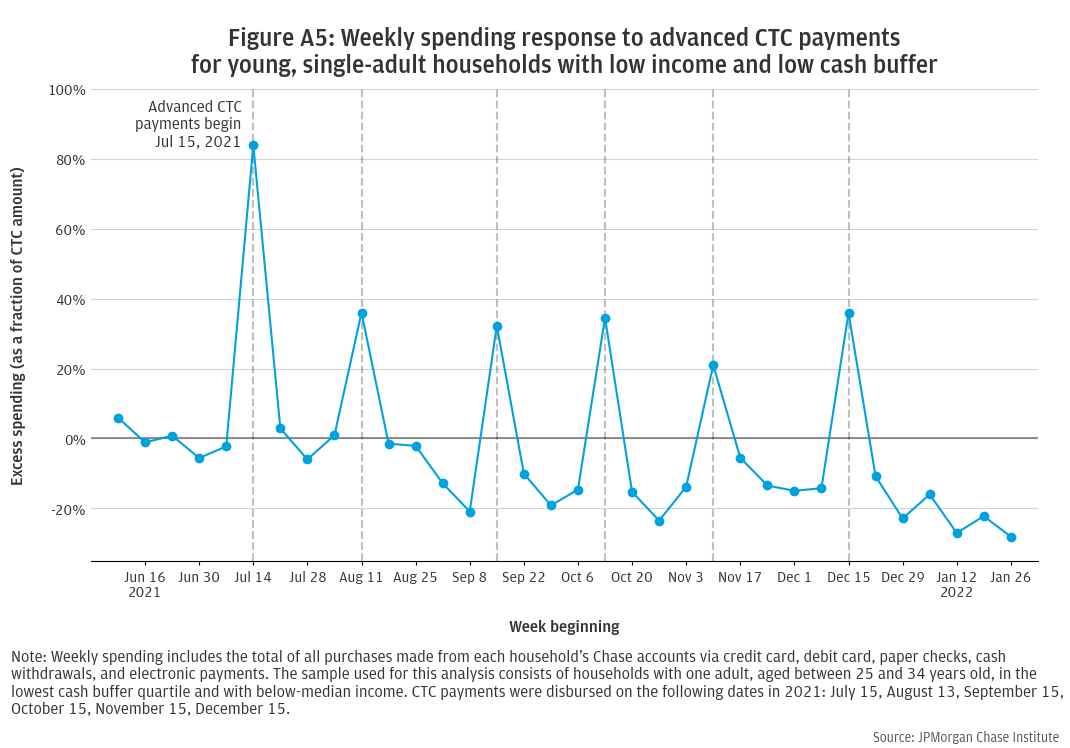

How families used the advanced Child Tax Credit, If you haven't filed or registered with the irs, now is the time to take action. At the beginning of march 2025, president biden’s proposed budget for 2025 includes a plan to renew and expand the child tax credit, a policy that has gained popularity and bipartisan support.